North Dakota Increases Investment in HIF

The North Dakota legislature approved $30 million in new tax credits and $5 million from profits from the Bank of North Dakota to the state’s Housing Incentive Fund (HIF) in April, building on the HIF’s first four years of success. Depending on the Bank of North Dakota profits in 2015, the legislature authorized the HIF to receive up to an additional $5 million for the 2015-2017 biennium.

Established by the legislature in 2011, the HIF has invested nearly $50 million in the development and preservation of more than 1,500 homes and apartments for working people and families throughout the state in its first two biennium of operation. The $50 million in HIF funds leveraged an additional $200 million in housing resources to the state. HIF funds are administered by the North Dakota Housing Finance Agency (NDHFA) and awarded in a competitive process.

Leading the advocacy effort to renew the tax credit and commit profits from the Bank of North Dakota was a coalition comprised of North Dakota NAHRO, the North Dakota Coalition for Homeless People, Lutheran Social Services and several of the western communities’ economic development commissions. “The HIF has been the primary tool in mitigating North Dakota’s housing crisis,” said Michael Carbone, Executive Director of the North Dakota Coalition for Homeless People, Inc. “Rents have begun to edge downward and vacancy rates are slowly increasing. We still have a long way to go before the supply and demand for affordable housing are in balance, but at least we seem to finally be moving in the right direction.”

The HIF was created to assist in meeting North Dakota’s need to increase the availability of affordable multifamily housing, especially to house essential service workers and low- and moderate-income families. The HIF prioritizes meeting the housing needs of local, county, school and state employees, long-term care and medical service workers, with a secondary priority of homes and apartments affordable to low- and moderate-income households. At least twenty-five percent of the fund must be used to assist developing communities with a population of not more than ten thousand to address unmet housing needs or alleviate a housing shortage. At least fifty percent of the fund must be used to benefit households with incomes of not more than 50% of the area median income. Eligible activities for HIF awards include:

- new construction of multifamily housing rental housing;

- substantial rehabilitation of existing uninhabitable multifamily buildings;

- substantial rehabilitation of a housing that is at risk of becoming uninhabitable/obsolete because of age and deterioration;

- substantial rehabilitation of existing uninhabitable due to flooding or other natural disaster;

- adaptive reuse of existing non-residential buildings that create additional housing units;

- use of HIF to retire debt and convert market-rate units to income- and rent restricted units affordable to households of low- or moderate-income;

- the acquisition and rehab of existing HUD or USDA affordable housing where the current owner is opting out of their federal contract and HIF funding is required to prevent the loss of the affordable inventory; and

- the purchase by a private entity of existing publicly-owned essential service worker housing resulting in the divestiture by the public entity while maintaining or increasing the supply of affordable housing for essential service workers.

The HIF requires NDFHA to conduct compliance monitoring, and utilize Land Use Restriction Agreements and recapture provisions to ensure that rent levels remain affordable for the intended tenants for the agreed upon time period.

The HIF is capitalized by contributions from taxpayers in exchange for tax credits and by a transfer of funds from the Bank of North Dakota. Any individual, business or financial institution with a potential state tax liability is eligible to contribute. A government entity or a tax-exempt organization is not precluded from making a contribution to HIF, however no tax credit certificate will be issued. Taxpayers receive a credit against their state income tax liability equal to their contribution to HIF. The credits are claimed in the tax year that the contribution was made. If a taxpayer cannot t use the entire tax credit in the first tax year, it may be carried forward for up to 10 tax years.

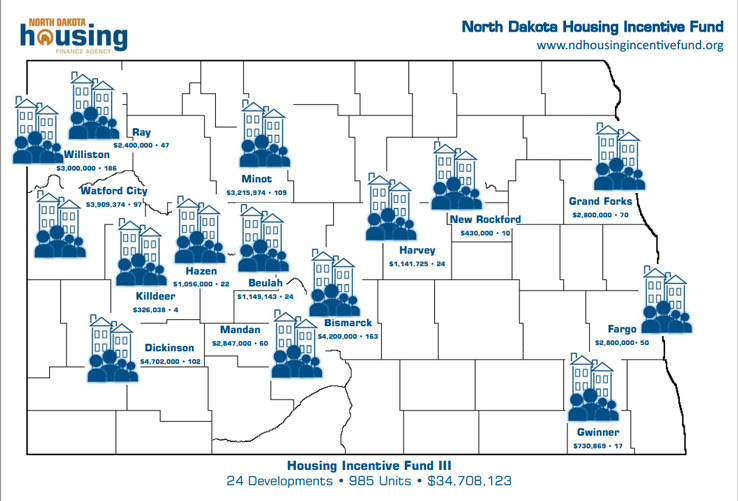

On May 30, 2015, NDFHA announced $34 million in first investments of the 2015-17 biennium that will produce another 985 homes and apartments in sixteen North Dakota communities. The housing will serve families, seniors, and people with disabilities, with 757 of the homes and apartments targeted to serve households at or below 50% Area Median Income, and 285 slated to house local, county, school and state employees, long-term care and medical service workers. In addition to housing created, the HIF investments will leverage an additional $150 million.