Housing trust funds are distinct funds established by city, county, or state governments that receive ongoing dedicated public funding sources to support the preservation and production of affordable housing and increase opportunities for families and individuals to access decent, affordable homes. Housing trust funds systemically shift affordable housing funding from annual budget allocations to the commitment of dedicated public revenue. While housing trust funds can also be a repository for private donations, they are not public/private partnerships, nor are they endowed funds operating from interest and other earnings.

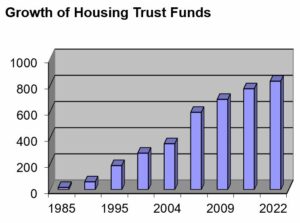

There are now 47 states with housing trust funds, the District of Columbia, Guam, and Puerto Rico, and more than 765 city and county housing trust funds in operation. They dedicate an excess of $3 billion annually to help address critical housing needs throughout the country.

Click here to download a list of state and local housing trust funds in the United States.

Housing trust funds are extremely flexible and can be used to support innovative ways to address many housing needs. The model can work in virtually any situation. They have been created to serve small towns of about 1000 people and the country’s largest states. These funds are also very efficient. Many housing trust funds report highly successful track records addressing a wide range of critical housing needs.

This website provides information about existing housing trust funds and strategies to help you craft a proposal for a housing trust fund and develop a campaign to advance it. It includes profiles of some of the most successful models created across the country and case studies describing their development. To learn more about the current impact of state and local housing trust funds, download the Housing Trust Fund Survey Report 2016. To request specific technical assistance, please visit our technical assistance page.